In the rapidly evolving world of ecommerce, measuring success goes beyond conventional metrics like sales and revenue. One often-overlooked but crucial determinant of a business’s longevity and prosperity is Customer Lifetime Value (CLV). This guide explains how to calculate CLV for ecommerce using Google Analytics.

Metrics to know before calculating customer lifetime value for ecommerce

Before diving into CLV calculations, understanding key metrics is essential:

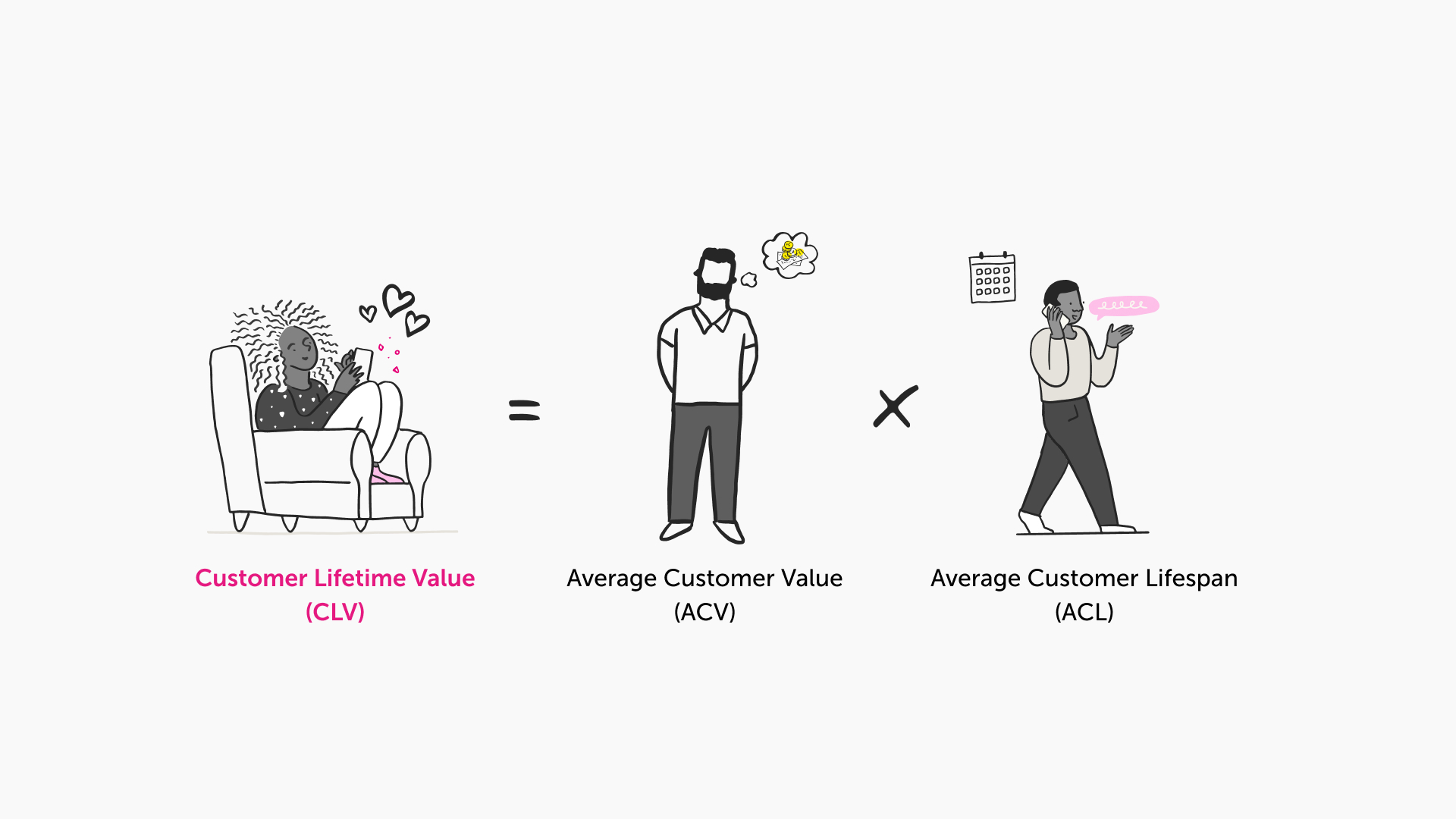

- Average Customer Value (ACV): ACV is the average revenue per customer in a specific period. It is calculated by multiplying the average purchase value by the purchase frequency rate. This foundational metric is pivotal for ecommerce how to calculate LTV.

- Average Customer Lifespan (ACL): represents how long a customer is expected to keep buying from your store. You calculate it by dividing the total customer lifespans by the number of customers. This is important for calculating customer lifetime value (LTV) in ecommerce.

Customer lifetime value formula

Armed with ACV and ACL, the CLV formula emerges: CLV = ACV x ACL. This formula tells you how much money a customer will make for your business throughout their entire relationship. It’s important for calculating LTV in ecommerce.

Why is the customer lifetime value (CLV) important for ecommerce?

Why is the customer lifetime value (CLV) important for ecommerce?

- Revenue Boost: Higher CLV contributes to increased revenue over time.

- Customer Loyalty Boost: Identifies issues and aids in boosting customer loyalty and retention.

- Targeting Ideal Customers: Assists in targeting and attracting high-value customers.

- Cost Reduction: Increasing CLV can help offset high customer acquisition costs.

- Financial Planning Simplification: CLV simplifies financial planning by providing insights into long-term revenue expectations.

- Product and Service Improvement: CLV trends guide improvements in products and services.

LTV to CAC ratio: understanding its importance

The LTV to CAC ratio is important in ecommerce. A good ratio, like 3:1, means sustainable growth and profit. This ratio balances the cost of acquiring a customer with the value they bring over their lifetime.

Factors Affecting LTV in Ecommerce

Several factors influence LTV in the ecommerce sector:

- Product Pricing: Correct pricing encourages repeat purchases, elevating LTV.

- Marketing Strategies: Effective strategies attract high-value customers and improve retention.

- Retention and Loyalty Programs: Engaging programs motivate repeat purchases, enhancing LTV.

- Customer Service Quality: Exceptional service boosts satisfaction, leading to loyalty and increased LTV.

Practical Application of CLV in Ecommerce

Let’s look at an example to show how CLV affects decision-making for an online business.

Example Scenario

A store named TrendyWardrobe wants to see if its marketing and customer retention strategies are effective. By calculating CLV, TrendyWardrobe can understand how valuable its customers are and adjust its strategies accordingly.

- Calculating ACV: To begin, TrendyWardrobe calculates the Average Customer Value (ACV). This involves determining the average purchase value and multiplying it by the purchase frequency rate. Let’s say the average purchase value is £50, and customers make purchases, on average, four times a year. Hence, the Actual Cash Value (ACV) equals £50 multiplied by 4, which is £200.

- Determining ACL: Next, TrendyWardrobe considers the Average Customer Lifespan (ACL). By analysing historical data, they find that the average customer continues to make purchases for five years. Therefore, the ACL is equivalent to 5 years.

- Applying the CLV Formula: With ACV and ACL in hand, TrendyWardrobe applies the CLV formula: CLV = ACV x ACL. Using the example figures, CLV = £200 x 5 = £1000.

The Impact

TrendyWardrobe now knows that each customer is worth £1000 in the long run. Armed with this information, they can make informed decisions about marketing budget allocation, customer retention initiatives, and overall business strategy.

Implementing CLV Insights with Google Analytics

Let’s explore how Google Analytics can effectively collect and analyze data for measuring CLV. First, it’s important to understand the significance and practical use of CLV.

- Setting Up Goals and Ecommerce Tracking: Google Analytics helps set goals and track online sales. By setting goals like purchases or newsletter sign-ups, you can track user actions that affect CLV.

- Utilising Enhanced Ecommerce Tracking: Take advantage of Google Analytics’ Enhanced Ecommerce Tracking to gain deeper insights into user behaviour throughout the purchase journey. This includes tracking product views, additions to the cart, and completed transactions.

- Integrating Customer Segmentation: Google Analytics allows for the segmentation of users based on various parameters. By segmenting users by acquisition channel, geographic location, or device type, you can identify high-value customer segments contributing significantly to CLV.

- Analysing User Lifetime Value Report: Google Analytics 4’s User Lifetime Value report provides insights into user groups’ performance. This report goes beyond traditional CLV by considering all users, not just customers. It provides a broader perspective on user engagement and value over time.

- Monitoring LTV Trends: Regularly monitor LTV trends over time to identify patterns and changes in user behaviour. Google Analytics lets you customise date ranges to see LTV based on specific time periods.

By leveraging the power of Google Analytics, ecommerce businesses can seamlessly integrate CLV insights into their decision-making processes. Google Analytics data helps businesses succeed by improving marketing, user experiences, and resource allocation for long-term success.

Customer Lifetime Value (CLV) is not just a metric; it’s a compass guiding ecommerce businesses towards sustained success. Businesses can make smart decisions by understanding the long-term value of each customer. This understanding allows them to connect with their audience effectively and increase profits.

This guide explains the importance of CLV in ecommerce, from basic metrics like ACV and ACL to real-life examples. Google Analytics helps businesses collect, analyze, and use CLV insights effectively.

As ecommerce continues to evolve, staying attuned to customer behaviour and leveraging tools like Google Analytics will be pivotal. By knowing and using CLV, businesses can thrive in the competitive online commerce world both now and in the future.

Lifetime Value Report in Google Analytics 4

Google Analytics 4 has a report called User Lifetime Value, showing user value based on overall performance. Unlike traditional CLV, User LTV includes all users, providing a broader perspective on performance. This additional insight is critical for ecommerce businesses looking to maximise their reach and impact.

Understanding the Impact of LTV in Ecommerce Business Success

CLV is a pivotal metric for ecommerce success. It helps predict business growth, guides marketing strategies, and improves customer retention in ecommerce by calculating LTV. Leveraging factors like product pricing, marketing, loyalty programs, and exceptional customer service can significantly boost LTV, fostering long-term success for your ecommerce business.

To succeed in ecommerce, stay updated and use tools like Google Analytics to unlock your business’s full potential. If you’re seeking deeper insights into your online business, our experienced Analytics team at Nomensa is ready to help.

By exploring the intricate interplay of these elements, ecommerce businesses can fine-tune their strategies for optimal performance. In the next sections, we will discuss how to use CLV in real-life situations. Additionally, we will provide a step-by-step guide on using Google Analytics to apply these findings.

We drive commercial value for our clients by creating experiences that engage and delight the people they touch.

Email us:

hello@nomensa.com

Call us:

+44 (0) 117 929 7333